The Formula for Achieving Success in Both Your Life and Wealth.

But, it doesn’t have to be this way. What if you wanted to improve certain key areas of your life from your social relationships and health or time with your family AND keep your financial and business or career goals on track too? What would that be like for you?

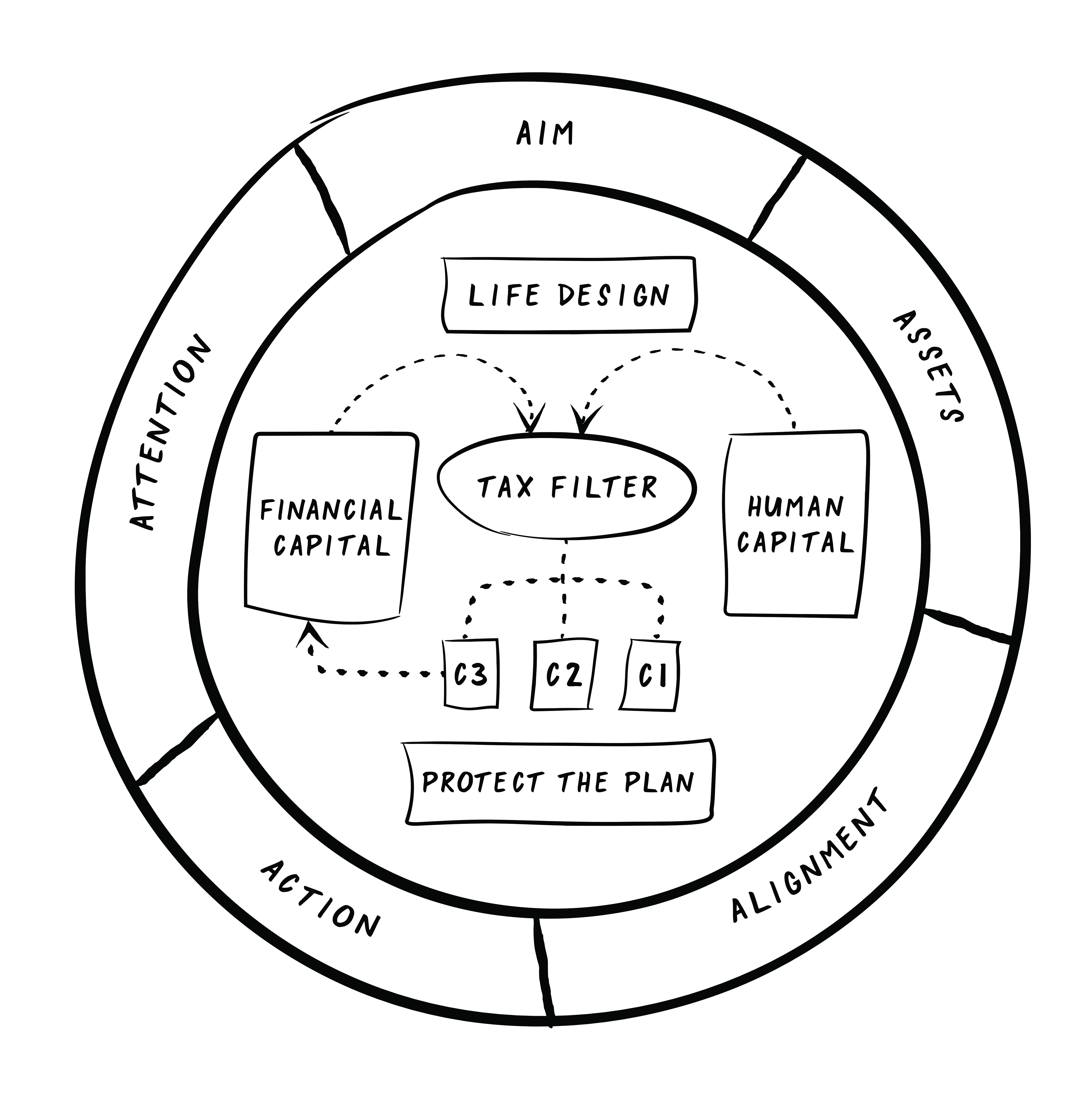

After a few years of achieving financial results for clients and noticing that they weren’t actually happier, I started to question much of my training. I researched and iterated. Four professional designations and two coach training programs later I created a methodology that is now the core of my private client work…I like to show it as a formula:

((Assets + Aim) x Alignment) + Action + Attention

When all of the 5 A’s of Achievement are fully engaged, the results follow.

Let’s take a closer look at each of the 5 A’s of Achievement and what goes into them. As we go through each of them, I encourage you to rate where you think you are right now.

Assets

This lever is all about your human capital – your skills, your knowledge, your experience – and your ability to generate income through your career or through entrepreneurship. The leverage comes from how well you convert your human capital to financial capital.

Aim

When I talk about aim, we’re focused on obtaining clarity around what you want. When I talk about aim in this context, you’re developing the skills that go into the act of designing. The short-sighted path here is to minimize this concept to goal-setting, particularly those “common goals” you can choose from a checklist or similarly an “investment objective” also chosen from a predetermined list, usually ranging from “conservative” to “aggressive”.

The key question is “What was the process you used to arrive at that goal, that outcome?” Goals need direction to be effective. Your money needs purpose. It can’t work for you without it.

So in Aim we’re doing the work of arriving at purpose. We start with very tactical, day-to-day issues to arrive at high level direction in the form of vision.

To begin arriving at Aim, we take inventory in three key areas:

1. Your life as measured via your level of satisfaction in the 7 Facets of Daily Living.

2. The cost of your lifestyle – which consists of the

- costs of daily living, and the

- costs associated with funding future planned expenses

3. Vision. A lot of people talk about vision as it relates to time, but in my opinion specific outcomes that are time based are actually goals. You need to think of vision as your future self or your future life without the constraint of time.

Do you know people who seem to be busy all the time, but don’t seem to move higher on the economic or life satisfaction meter? They’re chasing the latest financial fad or they’re following the prescription of rules of thumb they learned in a book and they can’t figure out why they’re not getting the results. It’s because the action doesn’t directly tie back to their aim. And this leads to the third A: Alignment.

Alignment

At its core, alignment is about being sure that you are building strategy. Think about what makes the difference between pros and amateurs in sports and in the performing arts. Amateurs do a whole bunch of things but they don’t have a strategy behind why they’re doing it. The pros usually have tight alignment between outcome and resources, which drives the specific action they take.

Alignment is effectively about controlling today for:

- Money. Cash flows in and out in the present, but the present cash flows include those commitments made in the past and an allocation to our future self. The question is how much to each?

- Time. How do you allocate your time to all of the projects and activities in the areas of life you want to improve?

- Resources. Again, what’s available to you and how can you best utilize them?

So, alignment is about knowing what to do, making decisions based on strategy rather than falling for the latest idea.

- Should you be focused on debt payoff like all the books and blogs tell you?

- Should you be focused on shifting at least 10% of take home wages into an investment account before you do anything else, like many blogs, books and programs tell you to?

- Should you always buy instead of rent?

Alignment is about how well our decisions are tied to our best opportunities, so it sets you up to take the action that has the most impact to your future.

This is where the ability to think strategically makes a big difference between selecting goals that become stepping stones vs those that are just keeping us busy.

Action

This is all about how well you are executing the projects needed to carry out the strategy.

- This is about your tax structuring

- This is about your spending plan

- This is about automating where you can

- This is about clear direction for your financial capital

- This is about building momentum through a lot of small wins

Attention

The last piece of this framework is attention. We need to measure and iterate.

- How well are you converting your human capital to financial capital?

- What is your Quality of Life (QOL) Indicator saying?

- How well is your business or career supporting the growth of your human and financial capital?

I know for many people measurement can be like fingernails on a chalk board but it’s necessary. Remember, the pro athletes and performers review their tape and their stats, then they work with their coach on what needs to be adjusted – that’s what got them to the pro level.

Seeing what the results are based on the actions you’re taking, plus how your financial capital is working and closing those information loops provides increased confidence. This leads to increased competency, and ultimately, to direct control.

The mastery level of this framework is to be so dialed in to your own life that if you make an adjustment in on area, you know how all the other areas will respond.

It’s about coordinating and integrating so that you can achieve a higher level of satisfaction and certainty in your life and lifestyle as well as moving that much closer to achieving financial independence. Applying this methodology as part of your annual planning process helps keep you on track for the year as well as making measurable progress toward your long-term milestones.